Covid 19 & The Markets – Part 1

This is part 1 of a look at the current Covid 19 virus crisis and the effect on the markets.

Credit for the information has to go to Blackrock and Castlestone Management for compiling the data and it reflects their opinions

With the effect the Coronavirus has had on markets around the world, it’s good to step back and see the situation for what it actually represents. Castlestone make 6 very good points –

- Firstly, as Goldman Sachs recently remarked, this is a health and confidence crisis, not a financial crisis. Unlike in 2008, the Banks now are in very good shape, with healthy balance sheets and are lending widely to consumers, so credit is flowing.

- Secondly, there is no systemic risk to the system. Government Financial Bodies across the world, like the US Federal Reserve, have acted aggressively and decisively to ensure that the fundamentals of their economies remain sound. For example reducing Fed rates and injecting cash into the system. Where businesses are being affected, large Government subsidies are being put together – for example in the US and France and shortly the UK.

- Thirdly, China & South Korea have shown that the Pandemic (like all Pandemics before it) has a timeframe – whose length depends on actions taken. The Peak has now passed in those countries and western countries will also eventually meet and move beyond their own peaks.

- Fourthly, we are already seeing firms in China, like Foxconn, start to tentatively head back online and get supply chains back in order. It won’t happen overnight, but it’s the system starting to fix itself again and head back to normality in due course. See article here – https://www.techradar.com/news/resumption-of-work-at-foxconns-chinese-factories-beats-expectations

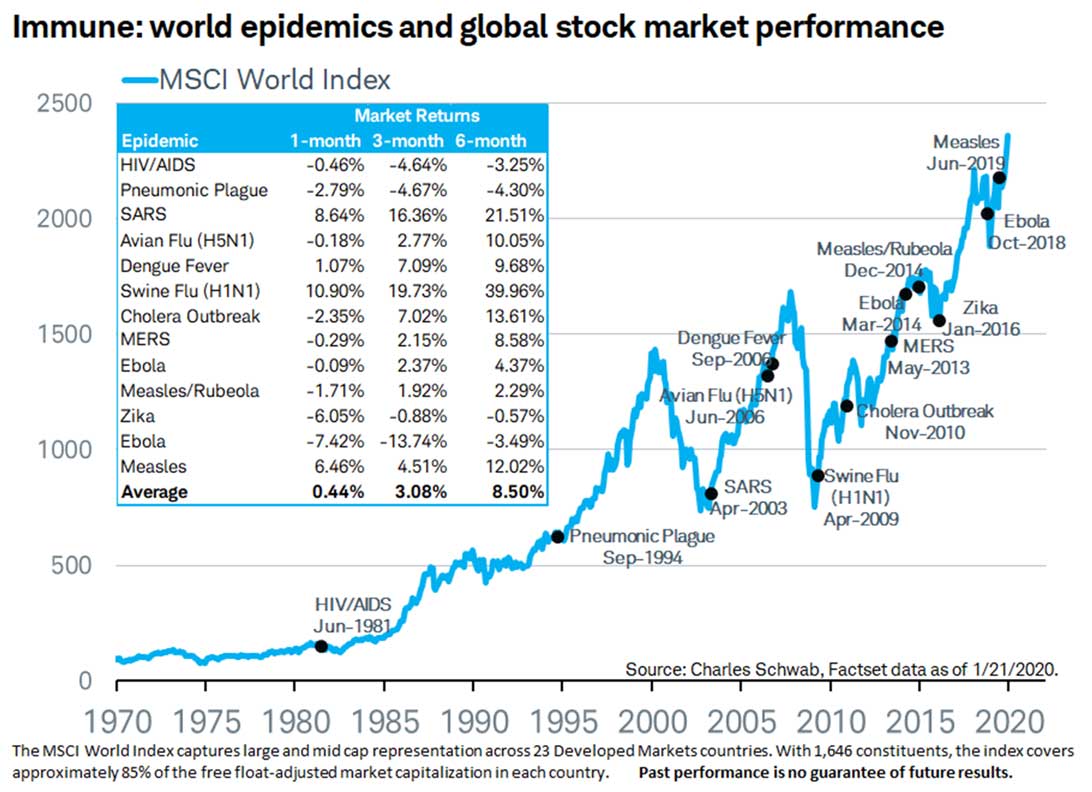

- Fifthly, both Morgan Stanley & Goldman Sachs can see an upcoming eventual rebound in the markets, now that we are seeing the end of the emotional sell off, triggered by health concerns over the Coronavirus. See the graph showing the way the MSCI reacted to past Pandemics and the positive movements in the markets after Pandemics had occurred.

- Finally, this is a better investing opportunity than 2009, because not only are market fundamentals more sound, but investors cannot get yield from elsewhere, for example Bonds, so we will see a large bounce back in equity valuations. With equity valuations at current levels, give or take a little bit more volatility, there are some great opportunities for buyers who are willing to look at the bigger long term picture.

This Is Not 2008

Although the scale of financial market moves in response to the coronavirus outbreak has been reminiscent of the global financial crisis. Blackrock do not think this is 2008, however.

The virus shock’s impact will likely be large and sharp, but they believe investors should be level-headed, take a longterm perspective and stay invested.

The economy is on more solid footing and, importantly, the financial system is much more robust than it was going into the crisis of 2008. We don’t see this as an expansion-ending event – provided that a pre-emptive and coordinated policy response is delivered.

They see encouraging signs that this policy response is starting to come together. It will need to be a joint and decisive effort between fiscal and monetary policy to go direct.

The key vulnerabilities that need to be addressed: cash challenges faced by companies, especially small- and medium-sized enterprises, and households.

Authorities have strong incentives to take aggressive public health measures to prevent the virus from spreading due to capacity constraints in the health care sector. This will likely result in a sharp and deep economic slowdown in the near term.

Market moves have been compounded by oil prices plunging more than 20% – on track for the biggest daily drop since in the early 1990s – as an OPEC pact to stabilize prices unraveled.

This should ultimately benefit global growth, but it also risks at least temporary financial and economic dislocations in energy-heavy sectors, such as emerging market commodity exporters and parts of U.S. high yield.

They believe is a time for investors to keep a long-term perspective. The ultimate depth and duration of the coronavirus’ economic impact are highly uncertain, but they still believe the shock should be temporary as the outbreak will eventually dissipate and economic activity will normalise –assuming the needed policy response is delivered.

Part 2 will go into further details of previous market recoveries and how this relates to the current pandemic

My goal is to provide you with only the most practical and relevant personal finance and investing information – stuff that might actually help you or someone you know.

Please feel free to email me anytime with your questions and you can also take advantage of my free 60-minute consultation by clicking the Contact Me Today

I would be happy to review your current financial plan, offer some tips for creating one or answer any questions you might have pertaining to your investments.

About the author

Colin MacGregor is an independent financial advisor with over 10 years experience in the advisory sector and has been based in Prague, Czech Republic since 2009.

0 Comments