Are your investments Spanish tax compliant?

As you may or may not know The Hacienda, AKA the Spanish taxman requires Spanish tax residents to declare overseas assets worth more than €50000, on form Modelo 720, this includes:

- Property (home in the UK perhaps)

- ISA’s, PEP’s, Investment Bonds both Onshore and Offshore, etc

- Bank accounts both onshore and offshore

- National Savings and Premium Bonds

- Protection policies

In the UK many people use ISA’s for their tax efficiency or offshore bonds for tax relief.

However, when you are living in a different jurisdiction these tax breaks are typically lost.

If tax resident in Spain these assets will incur savings income tax every year, the rate of tax ranges from 19-23% depending on which region the individual lives.

Am I Spanish tax resident?

Seems complicated, but establishing tax residency in Spain is very simple. You are a Spanish Tax Resident if:

- You’ve live in Spain for more than half a year in total

- You have your ‘centre of vital interests’ in Spain (home, kids school, dog, work etc.)

- These rules have been tightened up to include those who deliberately spend less than 183 days a year in Spain to avoid being tax-resident. There have been cases where car hire, flight details & credit card bills have all been used to prove time spent in Spain.

How can you pay less tax?

Using Spanish Compliant Bonds offer a direct tax advantage. Specifically designed plans for tax residents in Spain which offer income tax and succession tax advantages. The Hacienda recognises them as tax-efficient.

Probably the best way to illustrate this is by a direct comparison between non-compliant investments and Spanish compliant investments laid out below.

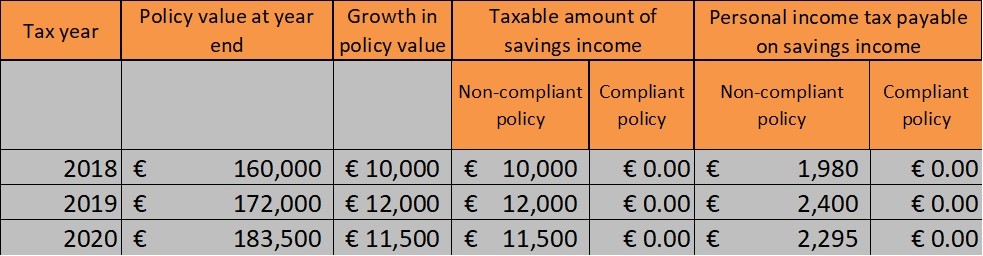

Taxation if no withdrawals for a compliant vs non-compliant policy

An individual has invested €150,000 in an investment bond; they have no other income from savings. If the investment is a non-compliant policy, the policyholder must declare the growth each year as savings income and pay tax on the total amount. However, if they invest in a Spanish compliant bond and make no withdrawals during the year, there will be no tax due.

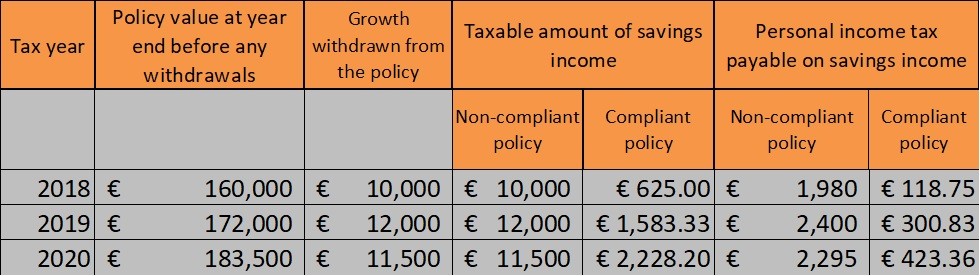

Taxation on withdrawals for a compliant vs non-compliant policy

An individual invests €150,000 in a Spanish compliant investment bond; they have no other income from savings. This time the policyholder withdraws the growth each year. The owner of the non-compliant policy will pay tax based on the growth of the plan as before. However, the owner of the Spanish compliant investment bond will only pay tax on the gain element of the withdrawal.

As you can see, there are tax savings to be had when investing in a Spanish compliant investment bond. On the one hand, if you don’t take money from your account there will be no tax to pay; on the other, if you do make withdrawals, the amount of tax payable will be significantly reduced.

How you benefit

- No need to declare on Modelo 720

- They are “tax-compliant” as seen by the Hacienda

- Tax is calculated by the bond provider and paid direct to the Hacienda on your behalf with no need for you to do any calculations or to pay someone else to do it

- No need for probate on death

- Multiple currencies available €, £, $ etc

- They are Inheritance Tax efficient

In conclusion, Spanish tax residents should look into opening a Spanish tax compliant bond to ensure their investments are benefiting from tax-efficient growth and/or income.

Indeed, one could argue that Spain is almost a ‘tax haven’ for retirees who use or intend to use personal investments to provide income!

If you would like more information on Spanish tax compliant bonds you can Contact Me Today for an initial informal chat and i can go over the options available and see how it would fit with your current situation.

I would also be happy to review your current financial plan, offer some tips on estate planning and answer any questions you might have.

Until next time happy saving and investing!

About the author

Colin MacGregor is an independent financial advisor working across Europe for Professional Investment Consultants S.A. (Europe) www.pic-europe.com.

He has over 10 years of experience in the advisory sector and currently resides in Prague, Czech Republic.

0 Comments