Covid 19 & The Markets – Part 2

Here in Part 2 I will go into further details of market recoveries and how this relates to the current pandemic.

Once again I wish to thank Castlestone Management for their input and research.

Volatility

Many market commentators believe we may have seen the market bottom over the previous week. Although we will not see a full recovery straight away, there is a perception that buyers are starting to return to the market.

We will see further volatility in the markets as the bad newsflow on infections keeps coming, but there are signs that peaks may have been reached and passed in China and South Korea and that global Governments are taking every measure to ensure the economic fallout from this event is reduced.

Markets tend to lead signs of economic recoveries by at least 6 months, so now may therefore be a good time to drip feed investments back into the market, as we start to see more confidence return, which will lead to a fledgling recovery building over time.

USA

We have seen a $2.2 Trillion rescue package announced in the US with spending and tax breaks including loans for small business, expansive unemployment insurance, tax deferrals and cheques to most American citizens adding considerable fiscal backing to the already comprehensive monetary measures taken by the Fed- Stimules Package

UK

In the UK Prime Minister Boris Johnson’s government has allocated a total of almost 57 billion pounds ($66 billion) in direct support. The U.K.’s economic action has set an example for coordination between monetary and fiscal policies. The latest measures announced by chancellor of the exchequer Rishi Sunak were praised as an attempt to prevent the crisis from causing mass unemployment.

Australia

Meanwhile in Australia the government passed legislation supporting a coronavirus economic stimulus package, worth $17.6 billion (8.7 billion GBP) , and a further $66 billion (32 billion GBP) in direct financial support announced in the second package over the weekend.

Governments have also included a raft of other measures to support their economies more broadly, as well as giving them flexibility to respond to changing circumstances without needing further legislation.

What Does History Tell Us?

As governments implement strategies to cope with the economic turndown Castlestone have again given us some historical data to look at in relation to previous market crashes which can provide investors with some very important information.

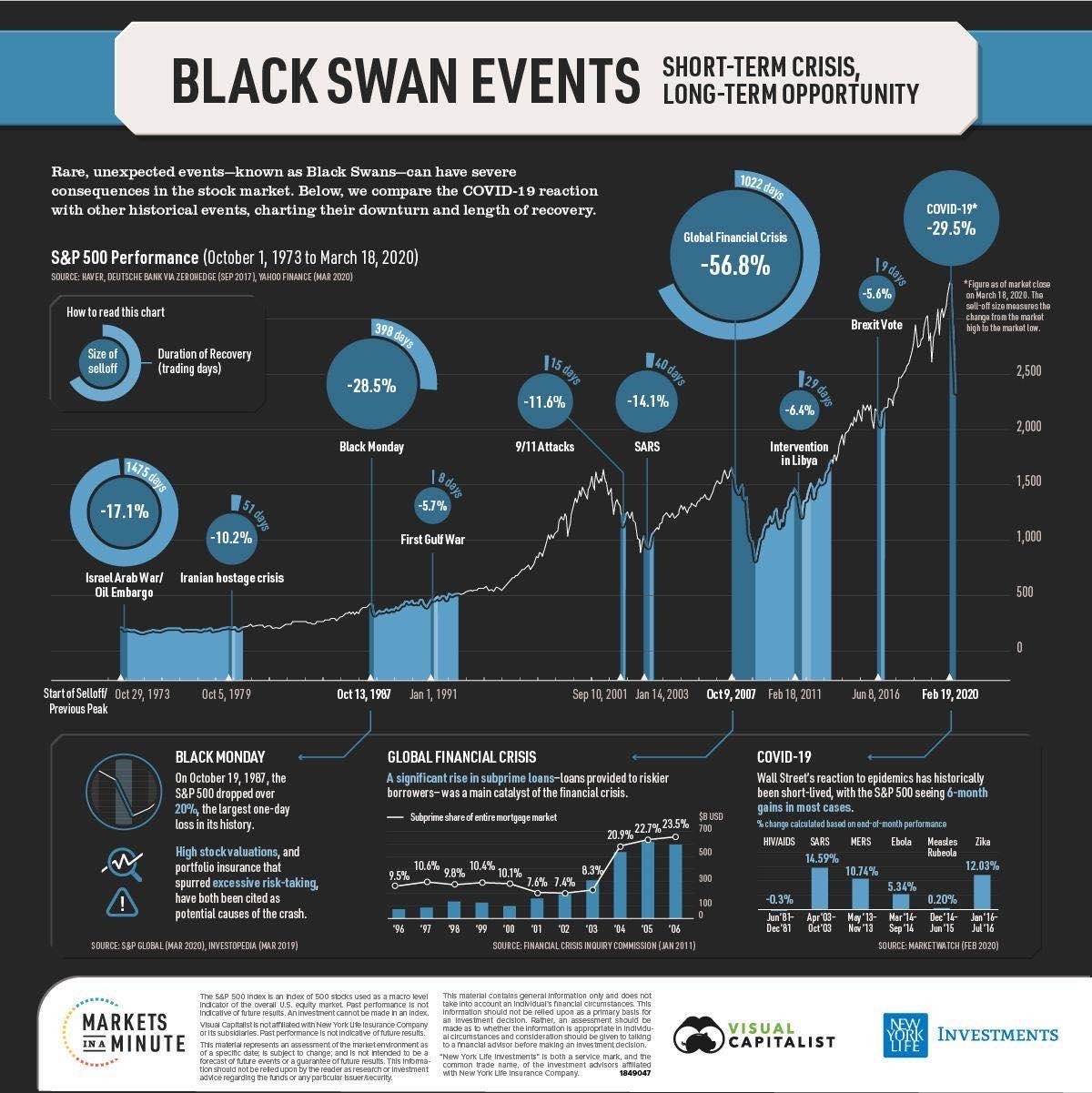

Firstly, Black Swan Events and their impact upon the Financial Markets.

A Black Swan is a rare unpredictable event that is beyond what is normally expected and has potentially severe consequences.

Black Swan events hitting the market, as defined by the S&P 500, have ranged from down 5% to down 57% between 1973 and 2020.

It is difficult to predict how long it will take for the market to recover from peak to trough – Bear Markets have lasted between 1200 days and 20 days. But history shows us the market always recovers-

“Be fearful when others are greedy and greedy when others are fearful”

Warren Buffett

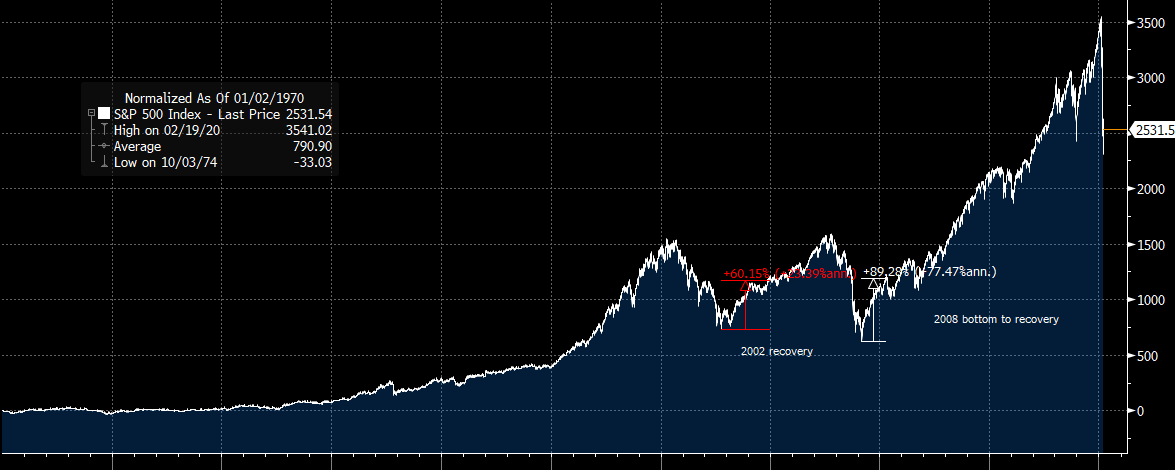

Secondly, Bear Market Drawdowns and the Subsequent Returns that have followed for long term investors.

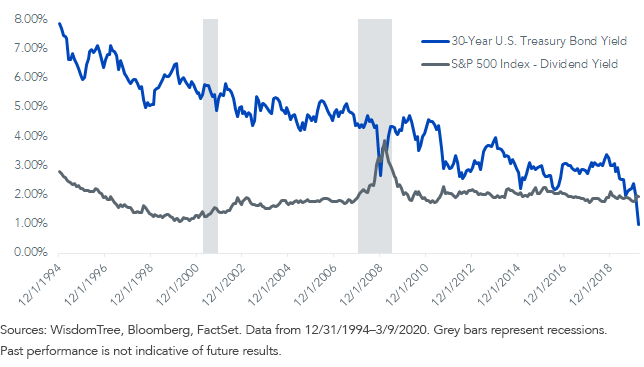

Finally, the updated S&P 500 Dividend Yield vs the 10 year US Treasury Yield, which as you can see as the equity markets have continued to remain under pressure the yield on the S&P 500 has inched higher.

Government bond yields did rally but came under additional pressure as new stimulus packages were announced.

When the equity rebound does come it will be sharp, as zero level interest rates drive the bond markets yields ever lower.

This will prove once again that in the search for yield, equities really are your best bet.

There Is Light At The End Of The Tunnel

We also know that markets tend to turn three months or so before economies do and if this crash works like most crashes, there is every chance that we will test the lows again. But there is definitely reason to start buying.

As with all pandemics to date we will most likely reach an end where all countries will overcome it and we will move on with our lives.

The human race is nothing but resilient and during the toughest of times must maintain a positive approach towards life.

The markets will recover as they have down in the past and economies will grow once again.

With any crisis comes opportunity and I suggest you check out my article on “When There is Blood in The Streets” to learn more about this.

If you are worried about your current portfolio holdings or would like more information on possible investment opportunities at this time you can take advantage of my free 60-minute consultation by clicking Contact Me Today for an initial informal chat.

I would be happy to review your current financial plan, offer some tips for creating one or answer any questions you might have pertaining to your investments.

About the author

Colin MacGregor is an independent financial advisor with over 10 years experience in the advisory sector and has been based in Prague, Czech Republic since 2009.

0 Comments